Top Insurance Companies in the USA

Insurance protects individuals, families, and businesses against sudden losses. The insurance market in the United States is very strong, with companies offering a range of policies designed to meet almost every need. From health and life insurance to auto and home coverage, these companies make sure that Americans are ready for anything life may throw their way. Understanding the types of insurance policies that everyone should know will significantly help in making apt decisions. This article presents a detailed overview of top insurance companies in the USA and the policies they offer.

Why Insurance Is Important

Insurance provides financial protection in case of accidents, natural disasters, or other unforeseen events. It ensures that individuals and businesses can recover without suffering devastating financial losses. Here are some reasons why insurance is vital:

- Financial Security: Covers unexpected expenses like medical bills or property damage.

- Peace of Mind: Reduces stress by providing a safety net.

- Legal Requirements: Some types of insurance, like auto insurance, are mandatory in many states.

- Business Insurance: Protects businesses from lawsuits, employee injuries, and other liabilities.

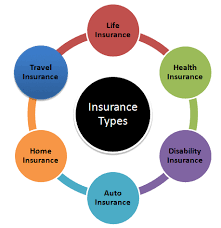

Types of Insurance Policies Everyone Should Know

Before listing the top companies, it is essential to know the types of insurance policies that everybody should know. These include:

- Health Insurance

- Life Insurance

- Auto Insurance

- Homeowners/Renters Insurance

- Disability Insurance

- Long-Term Care Insurance

- Business Insurance

Each type of insurance serves a particular purpose, ensuring that different aspects of life and work are covered.

Top Insurance Companies in the USA

Following are some of the top-ranked insurance companies in the country, based on their stability, customer service, and range of products offered.

1. State Farm

State Farm is among the leading and most well-liked insurance providers within the United States. Their “Like a Good Neighbor” slogan refers to offering vast policies of auto, home, and life insurances. The main reasons that place State Farm ahead of the pack include excellent customer service and a large agent network.

Key Features:

All-around auto insurance coverage includes discount opportunities for safe driving. Options for bundling with home and auto insurance.

Great mobile application for policy management.

2. GEICO

GEICO, with its recognizable gecko mascot, focuses on cheap auto insurance. It is considered a good option for those drivers who need relatively low premiums and swift service.

Key Features:

Affordable premiums with a variety of discounts.

Convenient web interface.

Possibility to get additional types of coverage: renters, motorcycle insurance, etc.

3. Progressive

Progressive is renowned for its innovation, from the “Name Your Price” tool that helps customers narrow down policies to fit their budget, to offering a wide array of insurance types.

Key Features:

Snapshot program for customized auto insurance rates.

Coverage for commercial vehicles and boats.

Strong customer support and claims process.

4. Allstate

Allstate’s “You’re in Good Hands” slogan reflects its commitment to excellent service. The company provides a broad range of insurance products, including home, auto, and life insurance.

Key Features:

Unique add-ons like identity theft protection.

Good bundling discounts for multiple policies.

Comprehensive digital tools and resources.

5. USAA

USAA is a top choice for military members, veterans, and their families. It’s renowned for its exceptional customer service and specialized policies.

Key Features:

Competitive rates for military families.

Financial services include banking and investment options.

High customer satisfaction ratings.

6. Nationwide

Nationwide provides a wide range of insurance and financial services. The company is recognized by its “On Your Side” promise and provides service for both individuals and businesses.

Key Features:

Home and auto insurance policies that can be tailored to fit.

Small business coverage available.

Strong online resources and tools.

7. Liberty Mutual

Liberty Mutual offers numerous insurance types for both individuals and businesses. It is also widely regarded for its flexible coverage options.

Key Features:

Full homeowners and renters insurance.

Accident forgiveness for auto insurance.

Global presence with international coverage options.

8. Farmers Insurance

Farmers is an established company offering a variety of insurance products. It’s known for its personal touch in service and educational resources.

Key Features:

Unique policies for landlords and small businesses.

Discounts available if multiple policies are bundled together.

Strong local agent network.

9. New York Life

Being one of the oldest mutual life insurance companies in the United States, New York Life has focused on life insurance and retirement planning.

Key Features:

Life insurance policies tailored to your needs.

Investment and annuity options.

Strong financial stability and customer service.

10. MetLife

MetLife provides a range of insurance products, from life and dental to disability insurance. It’s a top choice for group insurance plans provided by employers.

Key Features:

Dental and vision coverage comprehensive

Competitive term and whole life insurance rates

Strong global presence

Factors to Consider When Choosing an Insurance Company

The choice of the right insurance company depends on several factors. Here are some key points to keep in mind:

- Financial Strength: The ability of the company to pay claims as rated by agencies such as AM Best or Moody’s

- Customer Service: Companies with a high rating in customer satisfaction.

- Policy Options: Ensure they offer the types of insurance policies everyone should know.

- Pricing: Compare premiums and discounts to find affordable rates.

- Claims Process: A smooth and quick claims process is essential.

Emerging Trends in the Insurance Industry

The insurance landscape in the USA is constantly evolving. Here are some trends to watch.

- Digital Transformation: Companies are using AI and machine learning to streamline operations and personalize policies.

- Telematics: Usage-based insurance, especially for auto policies, is gaining popularity.

- Climate Risk Insurance: Coverage for natural disasters is becoming more important.

- Health Tech Integration: Health insurance providers are integrating wearable tech to track fitness and reduce premiums.

How to Make the Most of Your Insurance

To maximize the benefits of your insurance:

- Regularly review and update your policies.

- Bundle policies to save money.

- Avail of discounts, like safe driving or installing home security systems.

- Know the types of insurance policies that everyone should be aware of for maximum protection.

Conclusion

It is a vital decision to select the right insurance company, as it always needs to be done carefully according to one’s needs and preferences. The leading insurance companies in the USA come with varieties of policies, great customer service, and financial stability to help one protect himself and his assets more smoothly. Understanding what types of insurance policies everybody should be aware of, you’re all set to make decisions for a secured future.

Insurance is not just a financial product; it’s a commitment to protecting what matters most. Compare your options, compare companies, and choose the one that best suits your needs. With the right insurance partner, you can face life’s challenges with confidence and peace of mind.