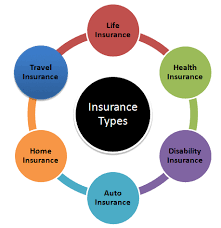

Types of Insurance Policies Everyone Should Know

Insurance provides a vital safety net against unforeseen events and uncertainties. From health to securing assets and ensuring your loved ones are well taken care of, getting the right insurance policies is very important. This article highlights the types of insurance policies everyone should know to make informed decisions about coverage that fits your needs and lifestyle.

Life Insurance

Life insurance is designed to provide money for your loved ones in case of your death. In this way, life insurance helps pay for funeral expenses, outstanding debts, and loss of income. There are primarily two types of life insurance:

- Term Life Insurance: It covers a specific period-for example, 10, 20, or 30 years. It is generally cheap, but no cash value is involved with this policy. For instance, young families often buy term life insurance to ensure funding for their children’s educations in the event that the worst should happen.

- Whole Life Insurance: It is a permanent policy that covers you throughout your life. It also accumulates cash value over time due to its savings component. Sometimes, whole life insurance can be used as an investment tool wherein the policyholder can borrow against the cash value that has built up. Life insurance is necessary for anyone who has dependants in their lives, as it gives financial stability during dire times.

Health Insurance

Health insurance is used to cover medical expenses, such as doctor visits, hospital stays, medication, and preventive care. With the rise in healthcare costs, health insurance will cover you in case of a medical emergency, so that you are not burdened with extra expenses. Common types of health insurance include:

- Employer-Sponsored Health Insurance: Health insurance provided by employers is a part of employee benefits. This is one of the most common ways people access health insurance.

- Individual Health Insurance: Directly bought by individuals from insurance companies. This type of health plan is meant for freelancers, the self-employed, or any individual who does not have any cover from an employer.

- Government Programs: In the United States, examples include Medicare and Medicaid. These are government-run programs to assist seniors, low-income individuals, and specific groups.

- Health insurance not only covers an individual for the care needed but also encourages preventive health measures that reduce the chances of further aggravated conditions.

Auto Insurance

Auto insurance is required in most countries and covers you against financial losses due to car accidents, theft, or damage. The major types of auto insurance coverage include the following:

- Liability Coverage: It covers damages to others’ property and medical expenses if you are at fault. This is the minimum requirement in most places.

- Collision Coverage: Pays for repairs or replacement of your car in an accident, regardless of fault.

- Full Coverage: Covers damage to your vehicle in non-collision incidents, including theft, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you in case the at-fault driver does not have enough insurance.

- Auto insurance premiums may vary depending on your driving record, age, and type of vehicle. Having proper coverage will save you a fortune in case of an accident.

Homeowners Insurance

Homeowners insurance provides financial protection for your home and belongings in case of damage, theft, or liability. It generally includes coverage for the following: Dwelling: Repairs or rebuilds your home after covered events like fires, storms, or vandalism. Personal Property:

- Protects belongings such as furniture, electronics, and clothing from damage or theft. Liability Protection: Covers legal costs if someone is injured on your property.

- Additional Living Expenses (ALE): Covers temporary housing expenses if your home becomes uninhabitable.

- Homeowners insurance is often a requirement by mortgage providers and is a protection of arguably your most valued asset.

Renters Insurance

Renters insurance is necessary if one is renting a home or apartment. It covers personal property, liability protection, and additional living expenses if your rental becomes uninhabitable. This policy is generally affordable and protects renters against unforeseen circumstances.

For instance, in case a fire damages your rental property, renters insurance can replace your belongings and pay for temporary housing. It can also provide liability protection in case a guest gets injured in your rented space.

Disability Insurance

Disability insurance provides income replacement if you’re unable to work due to illness or injury. It’s an essential policy for anyone who relies on their income to cover daily expenses. There are two main types:

- Short-Term Disability Insurance: Covers lost income for a few months. This is often offered as part of an employee benefits package.

- Long-Term Disability Insurance: Covers incidents for extended periods, typically up to retirement age. The self-employed commonly buy this cover as well in case of losing their income.

- Disability insurance keeps one in a decent position financially during bad times and helps avoid using savings or taking loans.

Travel Insurance

Travel insurance is necessary for frequent domestic or international travelers. The insurance covers the following list of travel risks:

- Trip Cancellation or Interruption: Reimburses non-refundable expenses if your trip is canceled or cut short due to unforeseen events like illness or natural disasters.

- Medical Emergencies: Covers healthcare costs incurred during travel, which can be significant in countries without reciprocal healthcare agreements.

- Lost or Delayed Luggage: Provides compensation for lost or delayed belongings, ensuring you can replace essential items.

- Emergency Evacuation: Reimburses the expense of medical evacuation to one’s home country, if necessary.

- Travel insurance provides peace of mind for your trips and helps you not be concerned about unexpected expenses.

Pet Insurance

For those with pets, pet insurance covers veterinary expenses for both illnesses, injuries, and routine care. Policies vary but typically include:

- Accident-Only Coverage: Covers treatment costs due to accidents, such as broken bones or ingestion of foreign objects.

- Comprehensive: Accident, illness, and preventative treatment, like vaccinations and teeth cleaning. Pet insurance sees to it that you give the best to your beloved animal friends without any financial stress on your part.

Liability Insurance

Liability insurance covers the legal and monetary consequences of causing harm to other people or their property in an accident. Common forms are: Personal Liability Insurance : This usually comes with your homeowners or renters insurance, extending to accidents that happen within your premises.

- Professional Liability Insurance: Covers professionals, such as doctors or lawyers, against malpractice. It is also referred to as errors and omissions insurance.

- Product Liability Insurance: This is important for businesses and covers any damage caused by defective products.

Liability insurance helps the business reduce the financial risks that may arise from the lawsuits.

Business Insurance

Business insurance protects an entrepreneur or business owner against risks, including damage to property, lawsuits, and injury to employees. Business insurance types include:

- General Liability Insurance: It covers third-party claims of bodily injury or property damage. Workers’ Compensation Insurance: It provides benefits to employees injured on the job, including medical expenses and lost wages.

- Commercial Property Insurance: It protects business property and equipment from damage or theft. Business Interruption Insurance: It covers lost income and operating expenses if your business is temporarily shut down due to a covered event.

- Business insurance is a critical investment to ensure continuity and protect your company’s assets.

Critical Illness Insurance

Critical illness insurance will pay a lump sum if you get diagnosed with a serious illness like cancer, heart attack, or stroke. You can use the proceeds for medical expenses, lifestyle changes, or replacing your income. It’s very helpful to cover expenses not covered by a standard health insurance plan, such as experimental treatments or traveling to see a specialist.

Long-Term Care Insurance

Long-term care insurance pays for the care needed for chronic illness, disability, or aging-related needs. It covers the services of nursing homes, assisted living, or in-home care. This insurance will be of growing importance with the aging population and is critical for dignity and comfort in later years.

Umbrella Insurance

An umbrella policy extends liability coverage beyond the limits of other insurances, such as automobile or homeowners. It’s a protective layer for individuals who could potentially face high-dollar lawsuits. For example, in an automobile accident, if the court awards damages that exceed the auto insurance limits, then an umbrella insurance policy would kick in, covering the difference, thereby safeguarding your savings and other assets.

Conclusion

Understanding the types of insurance policies that everybody should know is key to protecting yourself, your family, and your assets. Each policy has a different purpose, yet all offer financial stability when life throws up its uncertainties. You can assess your needs and risks to choose a combination of insurance policies for comprehensive coverage and peace of mind. Don’t wait for unexpected events to occur; start planning your insurance needs today!