The Role of Life Insurance in Retirement Planning

When people think about retirement planning, they often focus on savings, investments, and pensions. However, one important tool that should not be overlooked in retirement planning is life insurance. Life insurance can play a significant role in ensuring a financially secure and comfortable retirement, both for you and your loved ones. It provides not only a death benefit but also offers strategic advantages such as tax advantages, wealth preservation, and a source of income during retirement.

In this article, we will explore the different ways life insurance fits into retirement planning, its benefits, and how it can be used as part of a larger strategy for a secure retirement.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company. The individual pays premiums, and in return, the insurance company provides a lump sum payment, called a death benefit, to the beneficiaries of the policy when the insured person passes away. There are two main types of life insurance policies:

- Term Life Insurance: This policy provides coverage for a specified term, usually 10, 20, or 30 years. If the policyholder dies during the term, their beneficiaries receive the death benefit. If they outlive the term, there is no payout.

- Permanent Life Insurance: This policy lasts for the lifetime of the insured, provided the premiums are paid. It also accumulates cash value over time, which can be borrowed against or used as an investment.

While the primary purpose of life insurance is to provide financial protection to your beneficiaries in the event of your death, it can also be an effective tool for retirement planning. By strategically incorporating life insurance into your retirement planning, you can create a more robust and flexible strategy that meets your long-term goals.

The Importance of Life Insurance in Retirement Planning

1. Financial Protection for Your Loved Ones

The most obvious role of life insurance is to protect your loved ones financially after your death. For retirees who are still financially supporting dependents or want to ensure that their spouse maintains a comfortable lifestyle, life insurance can provide much-needed security. A death benefit can help cover funeral expenses, pay off outstanding debts, and replace lost income.

For example, if you are a retiree with a spouse who does not have substantial retirement savings of their own, life insurance can ensure that your spouse is not left struggling financially if you pass away. The death benefit can help them pay for living expenses and maintain their lifestyle.

2. Tax-Free Death Benefit

One of the most attractive features of life insurance is that the death benefit is generally tax-free to your beneficiaries. This can be particularly important in retirement planning because it allows your heirs to receive the full amount of the death benefit without worrying about tax implications. In addition to providing financial security to your loved ones, this benefit can also be used as a legacy-building tool. If leaving a legacy is important to you, life insurance can be an efficient way to ensure that your assets are passed on without the burden of taxes.

3. Building Cash Value for Retirement

Permanent life insurance, such as whole life or universal life insurance, offers the ability to accumulate cash value over time. This cash value grows tax-deferred, meaning you do not have to pay taxes on the growth of the cash value until you withdraw it. The cash value in these policies grows at a guaranteed minimum rate, and in some policies, it can grow faster depending on the performance of the insurer’s investments.

This cash value can be borrowed against or used to supplement your retirement income. For example, you may decide to take a loan from the cash value to cover emergency expenses or use it as a source of income during retirement. This is especially helpful if you have not accumulated enough savings in other retirement accounts, like a 401(k) or IRA.

However, it’s important to note that loans taken from your life insurance policy may accrue interest, and any outstanding loans, along with their interest, will be deducted from your death benefit when you pass away. Still, using the cash value of your life insurance can offer more flexibility in your retirement planning.

4. Supplementing Retirement Income

While life insurance is not typically used as the primary source of retirement income, it can be a valuable supplement. Permanent life insurance policies, which build cash value, offer the potential to borrow funds from the accumulated value of the policy. This can provide you with a source of income that does not require you to sell assets or tap into other retirement savings accounts.

Many retirees use this option if they face unexpected expenses or want to avoid depleting their retirement savings too quickly. Life insurance can thus act as an additional safety net or buffer to provide income in times of need.

Some people also use life insurance as a tax-efficient way to take distributions from their policy in retirement. Instead of drawing from taxable accounts, you can take loans or withdrawals from your life insurance policy’s cash value, which can reduce the amount of taxes you owe.

5. Tax Advantages for Retirement

Another way life insurance plays a role in retirement planning is through its tax advantages. Both the death benefit and the growth of the cash value in a permanent life insurance policy grow tax-deferred. This means that the value of the policy increases without being taxed until you take withdrawals. In addition, when the policyholder passes away, the death benefit is typically not subject to income tax for the beneficiaries, which can allow the family to keep the full amount of the death benefit.

In some cases, you may be able to use your life insurance policy as part of a strategy to reduce estate taxes as well. Since life insurance death benefits are generally not part of your estate, they can help your heirs avoid paying estate taxes on a portion of your wealth.

6. Flexibility in Estate Planning

For those who have accumulated significant wealth over their lifetimes, life insurance can be an essential part of estate planning. Estate taxes can be a significant burden on your heirs, potentially reducing the amount they inherit. Life insurance can be used to cover estate taxes, ensuring that your family members are not forced to sell valuable assets or liquidate portions of the estate to cover these costs.

Additionally, life insurance can be used to balance inheritances between family members. For example, if one child inherits a valuable family home, but you want to ensure that other children receive equal financial benefits, you could purchase life insurance to make up the difference. This helps ensure that all heirs receive a fair and equal share of your estate.

Types of Life Insurance to Consider for Retirement Planning

There are different types of life insurance policies that can be used as part of a retirement planning strategy. Here are the main types:

1. Term Life Insurance

Term life insurance is the most basic and affordable type of life insurance. It provides coverage for a specified period, typically 10, 20, or 30 years. It is designed to provide financial protection to beneficiaries if the policyholder dies during the term.

While term life insurance doesn’t build cash value and may not be as useful for accumulating wealth, it can still be useful for retirees who want affordable coverage to protect their spouse or family from financial hardship. It can also serve as a temporary solution if you still have significant financial obligations that may decrease over time (e.g., a mortgage or children’s education expenses).

2. Whole Life Insurance

Whole life insurance is a form of permanent life insurance that provides coverage for your entire life, as long as you continue to pay premiums. It also builds cash value over time, which can be borrowed against or used for retirement income.

Whole life insurance policies are more expensive than term life policies, but they offer guaranteed cash value growth and a fixed premium. This makes them a good option for individuals who want a combination of lifelong coverage and the ability to accumulate savings for retirement.

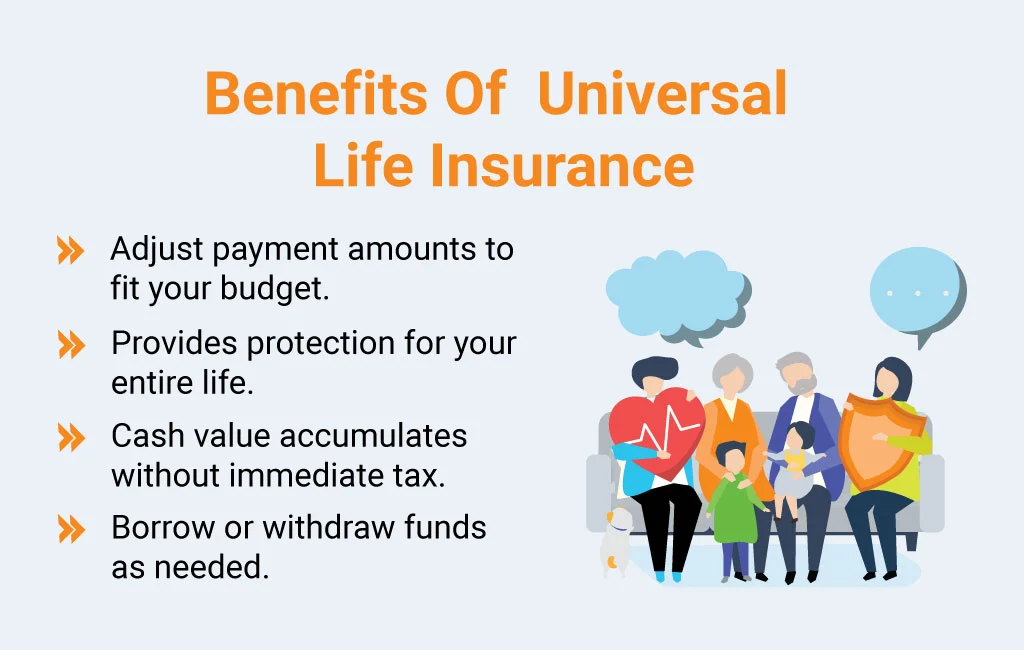

3. Universal Life Insurance

Universal life insurance is another form of permanent life insurance that offers flexibility. It allows policyholders to adjust the premiums and death benefits to fit their needs. Universal life insurance policies also accumulate cash value, but the growth is not guaranteed like in whole life insurance. However, the flexible nature of universal life insurance makes it an appealing option for those who want to adjust their coverage as their needs evolve.

Universal life insurance can be a good option for those who anticipate changes in their financial situation and want the flexibility to adjust their retirement planning strategy accordingly.

4. Variable Life Insurance

Variable life insurance is another type of permanent life insurance that allows you to invest the cash value in various investment options such as stocks, bonds, or mutual funds. While this can potentially result in higher returns, it also involves more risk compared to whole life or universal life insurance.

Variable life insurance may be suitable for those who are comfortable with the risks of investing and want the opportunity to grow their retirement funds more aggressively. However, this type of policy requires careful management and a good understanding of the investment options available.

Conclusion

Life insurance is an important tool that can play a significant role in retirement planning. Whether you are looking to provide financial protection for your loved ones, build cash value for retirement, or leave a legacy, life insurance can offer benefits that go beyond the traditional role of providing a death benefit.

When used strategically, life insurance can provide tax advantages, flexible retirement income, and protection for your heirs. However, it is important to evaluate your financial situation, goals, and retirement plans to determine which type of life insurance best suits your needs.

By including life insurance in your retirement planning, you can create a more comprehensive strategy that ensures a secure and fulfilling retirement for both you and your family.