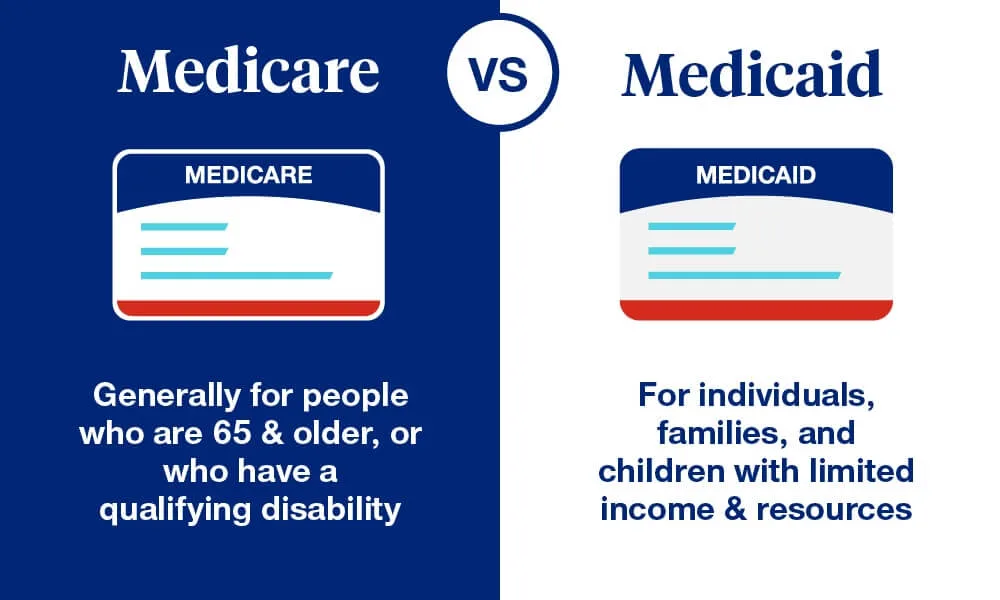

Medicare vs. Medicaid: What’s the Difference?

When it comes to healthcare in the United States, two major programs often come to mind: Medicare and Medicaid. While these programs share similarities, they serve different purposes and target different groups of people. Understanding the key differences between Medicare and Medicaid can help individuals make informed decisions about their healthcare needs. In this article, we will explore what Medicare and Medicaid are, who they serve, what services they cover, and how they are funded.

What Is Medicare?

Medicare is a federal health insurance program primarily designed for individuals who are 65 years or older, although younger individuals with certain disabilities or illnesses may also qualify. Established in 1965 under the Social Security Act, Medicare aims to provide affordable healthcare coverage to seniors and those with specific medical conditions.

Eligibility for Medicare

- Age-based Eligibility: Most people qualify for Medicare when they turn 65, provided they or their spouse have worked and paid Medicare taxes for at least 10 years.

- Disability-based Eligibility: Individuals under 65 can qualify if they have received Social Security Disability Insurance (SSDI) for 24 months.

- Specific Medical Conditions: People with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) qualify regardless of age.

Parts of Medicare

Medicare is divided into four parts, each covering different aspects of healthcare:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare.

- Part B (Medical Insurance): Covers outpatient care, doctor visits, preventive services, and medical supplies.

- Part C (Medicare Advantage): Offers an alternative to Original Medicare through private insurance plans that often include additional benefits like dental and vision coverage.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription medications.

Cost of Medicare

Medicare is not entirely free. While Part A is usually premium-free for most people, Parts B, C, and D require monthly premiums, deductibles, and co-payments. Additionally, there may be penalties for late enrollment.

What Is Medicaid?

Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. Unlike Medicare, Medicaid’s eligibility criteria and benefits vary by state, as states have the flexibility to design their own programs within federal guidelines.

Eligibility for Medicaid

Eligibility for Medicaid depends on income, household size, and other factors. Key groups that qualify include:

- Low-income families and children: Medicaid covers a significant percentage of children from low-income households.

- Pregnant women: Many states offer Medicaid coverage for pregnant women with limited incomes.

- Elderly individuals: Seniors who require long-term care and have limited assets often qualify.

- People with disabilities: Individuals with disabilities who meet income and asset criteria are eligible.

- Expansion Population: Under the Affordable Care Act (ACA), many states have expanded Medicaid to include low-income adults without dependent children.

Services Covered by Medicaid

Medicaid covers a wide range of services, including:

- Inpatient and outpatient hospital services

- Doctor visits

- Nursing home care

- Home health services

- Prescription drugs

- Mental health and substance use treatment

- Preventive care, such as immunizations and screenings

Cost of Medicaid

For most beneficiaries, Medicaid is free or low-cost. Some states may charge small co-payments for certain services, but these are typically minimal.

Key Differences Between Medicare and Medicaid

While Medicare and Medicaid share the goal of improving healthcare access, they differ in several fundamental ways:

1. Eligibility

- Medicare: Primarily based on age (65 and older) or specific medical conditions.

- Medicaid: Based on income and other factors, such as family status or disability.

2. Coverage

- Medicare: Focuses on healthcare for seniors and specific medical conditions, covering hospital stays, doctor visits, and prescription drugs.

- Medicaid: Offers comprehensive coverage for low-income individuals, including long-term care services that Medicare does not cover extensively.

3. Funding

- Medicare: Entirely federally funded and administered.

- Medicaid: Jointly funded by federal and state governments, with states managing their programs.

4. Costs to Beneficiaries

- Medicare: Requires premiums, deductibles, and co-pays, especially for Parts B, C, and D.

- Medicaid: Generally free or low-cost, with minimal out-of-pocket expenses for beneficiaries.

5. Administration

- Medicare: Uniform across the country with standardized benefits.

- Medicaid: Varies by state, leading to differences in eligibility and coverage.

Dual Eligibility: Medicare and Medicaid

Some individuals qualify for both Medicare and Medicaid. This group, known as “dual eligibles,” often consists of low-income seniors or disabled individuals. Dual eligibles benefit from both programs, as Medicaid can help cover Medicare’s out-of-pocket costs, such as premiums and co-payments. Additionally, Medicaid may offer services not covered by Medicare, such as long-term care.

How Are Medicare and Medicaid Funded?

Medicare Funding

Medicare is funded through:

- Payroll Taxes: Employees and employers each contribute 1.45% of wages to Medicare, with an additional 0.9% surtax for high-income earners.

- Premiums: Beneficiaries pay monthly premiums for Parts B, C, and D.

- General Revenue: Additional funding comes from the federal government’s general revenue.

Medicaid Funding

Medicaid is jointly funded by:

- Federal Government: Provides a fixed percentage of funding based on the Federal Medical Assistance Percentage (FMAP).

- State Governments: States contribute the remaining funds and manage their programs.

Challenges Facing Medicare and Medicaid

1. Rising Costs

Both programs face financial challenges due to rising healthcare costs, an aging population, and increased enrollment.

2. Access to Care

Medicaid beneficiaries may face difficulty finding providers who accept Medicaid due to lower reimbursement rates compared to Medicare and private insurance.

3. Fraud and Abuse

Both programs are susceptible to fraud and abuse, leading to increased costs and reduced resources for legitimate beneficiaries.

4. Policy Changes

Changes in federal or state policies can impact the availability and scope of services under Medicaid, while Medicare may face adjustments in funding and benefits.

Conclusion

Medicare and Medicaid play vital roles in the U.S. healthcare system, ensuring access to medical care for seniors, low-income families, and individuals with disabilities. While they differ in terms of eligibility, coverage, and funding, both programs aim to improve health outcomes for vulnerable populations. Understanding these differences can help individuals navigate their healthcare options and make informed decisions.

Whether you are approaching retirement age, managing a chronic condition, or seeking coverage for your family, knowing the ins and outs of Medicare and Medicaid can provide clarity and peace of mind. By staying informed, you can ensure that you or your loved ones receive the care they need without unnecessary financial strain.