Differences Between Term and Whole Life Insurance

Life insurance is an essential financial tool designed to provide financial security for your loved ones in the event of your death. It ensures that your family can maintain their lifestyle, pay off debts, or meet long-term financial goals even when you are no longer around. Among the types of insurance policies everyone should know, term and whole life insurance are the most commonly discussed options. Understanding their differences can help you make informed decisions that align with your financial goals and needs.

In this article, we will explore the key differences between term and whole life insurance, their pros and cons, and how they fit into the broader spectrum of insurance policies. By the end, you will have a clear understanding of which policy might be the right choice for you.

What is Term Life Insurance?

Term life insurance is a straightforward type of life insurance policy that provides coverage for a specific period, such as 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit. However, if the term expires and the policyholder is still alive, the coverage ends, and there is no payout.

Key Features of Term Life Insurance

- Affordable premiums make it an attractive option for young families or individuals with limited budgets.

- Fixed term coverage requires renewal or conversion if continued coverage is needed.

- No cash value is accumulated over time.

- Customizable lengths allow tailoring to specific needs, such as paying off a mortgage or raising children.

Advantages of Term Life Insurance

- Cost-effective for substantial coverage at an affordable rate.

- Simplicity makes it easy to understand and manage.

- Flexibility includes options to convert to whole life insurance if needs change.

Disadvantages of Term Life Insurance

- No savings or investment component is included.

- Coverage ends unless renewed or converted, often at higher premiums.

What is Whole Life Insurance?

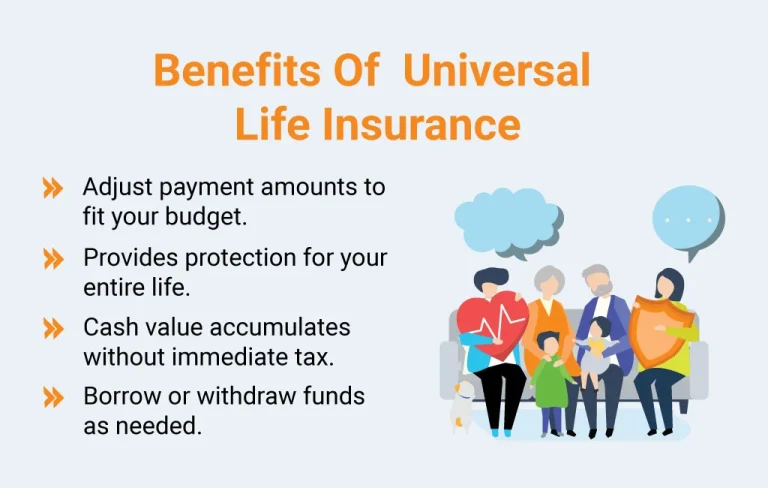

Whole life insurance is a permanent policy that provides coverage for the policyholder’s entire life. It includes a savings component, known as the cash value, which grows over time and can be borrowed against or withdrawn.

Key Features of Whole Life Insurance

- Lifetime coverage guarantees a death benefit if premiums are paid.

- Cash value accumulation allows borrowing or withdrawals.

- Fixed premiums remain consistent throughout the policyholder’s life.

- Tax advantages include tax-deferred cash value growth and tax-free death benefits.

Advantages of Whole Life Insurance

- Lifetime protection ensures consistent coverage.

- The savings component can act as an emergency fund or supplement retirement income.

- Fixed premiums provide long-term financial predictability.

Disadvantages of Whole Life Insurance

- High premiums make it significantly more expensive than term life insurance.

- Complexity arises due to the savings and investment components.

- Lower returns on the cash value compared to other investment options.

Key Differences Between Term and Whole Life Insurance

- Coverage Duration

- Term life insurance provides coverage for a set period.

- Whole life insurance offers lifetime coverage.

- Premium Costs

- Term life insurance premiums are lower and level for the term.

- Whole life insurance premiums are higher but consistent.

- Cash Value

- Term life insurance does not accumulate cash value.

- Whole life insurance builds cash value over time.

- Purpose

- Term life insurance is ideal for temporary needs like income replacement.

- Whole life insurance suits long-term goals like estate planning.

- Flexibility

- Term life insurance has limited flexibility and expires after the term.

- Whole life insurance provides flexibility through cash value and lifetime coverage.

How to Decide Which Policy is Right for You

When to Choose Term Life Insurance

- Limited budget with a need for substantial coverage.

- Temporary needs, such as until children are financially independent.

- Preference for a straightforward policy.

When to Choose Whole Life Insurance

- Lifetime coverage for your family.

- Interest in building cash value over time.

- Focus on estate planning and leaving a legacy.

The Role of Term and Whole Life Insurance in Financial Planning

Term life insurance addresses short-term needs, such as debt repayment or income replacement, while whole life insurance supports long-term goals, like wealth transfer and retirement income. Combining both policies can provide a balanced approach.

Common Myths About Life Insurance

- Young people don’t need life insurance – Early policies save money over time.

- Whole life insurance is always better – Its high premiums may not suit everyone.

- Term life insurance is a waste of money – It provides affordable, critical coverage.

- Employer-provided life insurance is sufficient – Often, it offers limited coverage.

Emerging Trends in Life Insurance

- Customizable policies with added benefits.

- Digital transformation simplifies purchasing and management.

- Usage-based premiums adjust based on lifestyle habits.

- Financial literacy initiatives improve consumer decision-making.

Conclusion

Understanding the differences between term and whole life insurance helps you make informed decisions about your financial future. Both have unique advantages and disadvantages, with the right choice depending on your individual needs and goals. Ensure your loved ones are financially protected by evaluating your options and consulting a financial advisor.